sacramento property tax rate 2021

The median property tax on a 32420000 house is 340410 in the United States. Citizens pay roughly 291 of their yearly income on property tax in Sacramento County.

Map Of City Limits City Of Sacramento

Search Valuable Data On A Property.

. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento County is located in northern California and has a population of just over 15 million people. Start Your Homeowner Search Today.

10000 485208. Learn all about Sacramento real estate tax. 2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Ad Research Is the First Step to Lowering Your Property Taxes. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of.

Ad Get In-Depth Property Tax Data In Minutes. The property tax rate in the county is 078. Transfer tax can be assessed as a percentage of the propertys final sale price or simply a flat fee.

The minimum combined 2022 sales tax rate for Sacramento California is 875. The Sacramento County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Sacramento County and may establish the amount of tax due on that property based on the fair market value appraisal. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Identify the total amount of your state county city transfer tax. Enter Your Address to Begin. 110 for each 1000.

Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 00249 12082. How is property tax calculated in Sacramento.

025 to county transportation funds. California state tax rates are 1 2 4 6 8 93 103 113 and 123California state tax rates and tax bracketsTax rateTaxable income bracketTax owed10 to 178641 of taxable income. 00918 44542.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. The median property tax on a 32420000 house is 239908 in California. Tax rate Tax amount.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The median property tax on a 32420000 house is 220456 in Sacramento County. Browse Current and Historical Documents Including County Property Assessments Taxes.

The County sales tax rate is 025. Another initiative seeking to exceed the 1 tax-rate limit is the Tax Cut and Housing Affordability Act initiative 21-0032. Los Rios Coll Gob.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Its also home to the state capital of California. The Sacramento sales tax rate is 1.

2021-22 1036 104 101036 1 Increase to base year value is limited to 2 percent pursuant to California Constitution article XIII A section 2b. Exemptions are available in Sacramento County. Sacramento County Assessors Office Services.

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Learn more About Us. The minimum combined 2022 sales tax rate for Sacramento County California is.

Such As Deeds Liens Property Tax More. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. Tax Collection and Licensing. The California sales tax rate is currently 6.

Based on that rate the average Sacramento County tax bill is about 2204 a year. This is the total of state county and city sales tax rates. Its also home to the state capital of California.

Personal property tax rates will decrease from 7346 cents to 659 cents per 100 of assessed valuation. Calculating The Sacramento County Transfer Tax. 2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 Level AA success criteria published by the Web. Sacramento Countys average tax rate is 68 of assessed home values slightly less than the state average of 74.

Our Mission - We provide equitable timely and accurate property tax assessments and information. What is the California state tax rate for 2021. View the E-Prop-Tax page for more information.

To calculate the amount of transfer tax you owe simply use the following formula.

Sacramento County Ca Property Tax Search And Records Propertyshark

Sacramento County Ca Property Tax Search And Records Propertyshark

California Gas Prices Average Soars Above 5 Per Gallon The Sacramento Bee

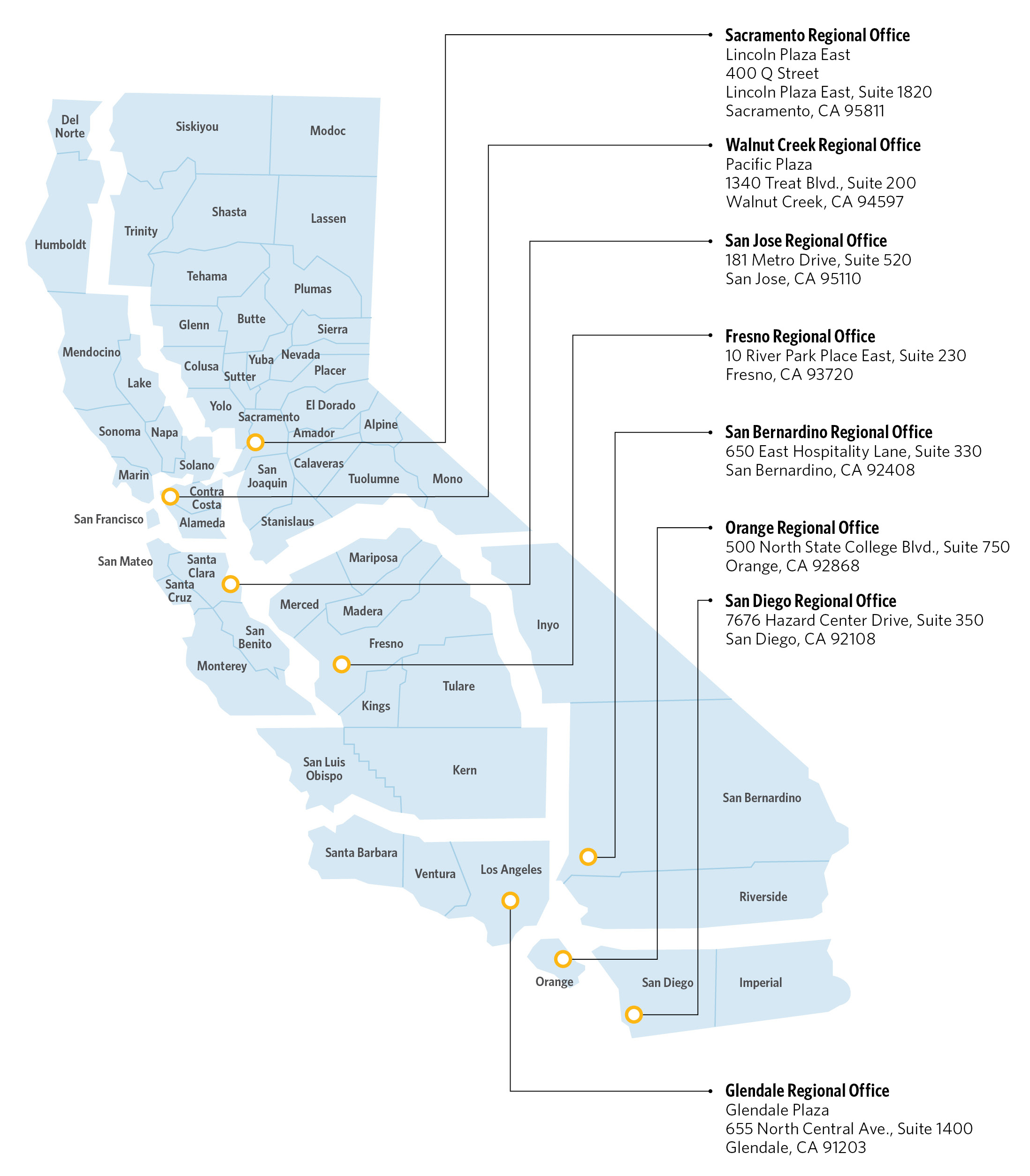

Headquarters Regional Offices Calpers

Calfresh Sacramento 2022 Guide California Food Stamps Help

Pin By Merissa Stater On Buyers Packets Date Activities Checklist Surveying

Non Standard Auto Insurance Companies In California

Ryan Lundquist Real Estate Appraiser Home Facebook

Sacramento County Property Tax Anderson Business Advisors

Sacramento County Property Tax Anderson Business Advisors

Calfresh Sacramento 2022 Guide California Food Stamps Help

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Sacramento County Ca Property Tax Search And Records Propertyshark

Pin By Nathaniel Key On Real Estate In 2021 Boise City Sunnyvale Housing Market

Sacramento County Ca Property Tax Search And Records Propertyshark

Sacramento Vs Portland Comparison Pros Cons Which City Is Better For You